All Categories

Featured

Table of Contents

If you are, an instant annuity might be the best choice. No issue what option you pick, annuities help supply you and your household with economic security.

Guarantees, including optional benefits, are backed by the claims-paying capability of the company, and might consist of constraints, including abandonment charges, which may impact plan worths. Annuities are not FDIC insured and it is possible to shed cash. Annuities are insurance policy products that require a costs to be paid for acquisition.

Please contact a Financial investment Professional or the issuing Firm to obtain the prospectuses. Please read the programs very carefully prior to investing or sending out cash. Capitalists need to consider financial investment purposes, threat, costs, and expenses meticulously before spending. This and other essential information is contained in the fund syllabus and recap prospectuses, which can be gotten from a financial specialist and need to be checked out thoroughly prior to spending.

Annuity Guys Ltd. and Client One Securities, LLC are not connected.

Speak with an independent insurance representative and inquire if an annuity is ideal for you. The worths of a fixed annuity are ensured by the insurance provider. The warranties relate to: Settlements made collected at the rate of interest prices applied. The money worth minus any kind of fees for paying in the policy.

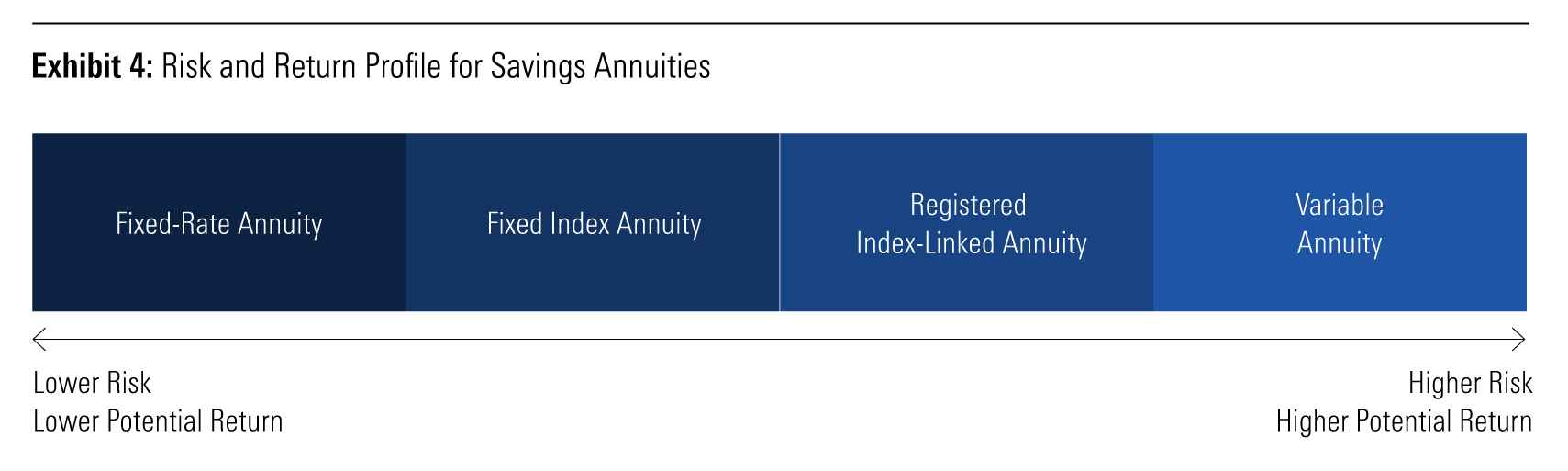

The price related to the money worth. Repaired annuity rate of interest prices supplied modification routinely. Some fixed annuities are called indexed. Fixed-indexed annuities supply growth potential without stock exchange threat. Index accounts credit a few of the gains of a market index like the S&P 500 and none of the losses. The values of a variable annuity are financial investments selected by the proprietor, called subaccount funds.

Decoding How Investment Plans Work Key Insights on Your Financial Future What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Different Retirement Plans Why Fixed Interest Annuity Vs Variable Investment Annuity Is Worth Considering Fixed Indexed Annuity Vs Market-variable Annuity: A Complete Overview Key Differences Between What Is Variable Annuity Vs Fixed Annuity Understanding the Risks of Long-Term Investments Who Should Consider Annuity Fixed Vs Variable? Tips for Choosing Choosing Between Fixed Annuity And Variable Annuity FAQs About Fixed Vs Variable Annuity Pros Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuities A Beginner’s Guide to Annuities Fixed Vs Variable A Closer Look at Fixed Index Annuity Vs Variable Annuities

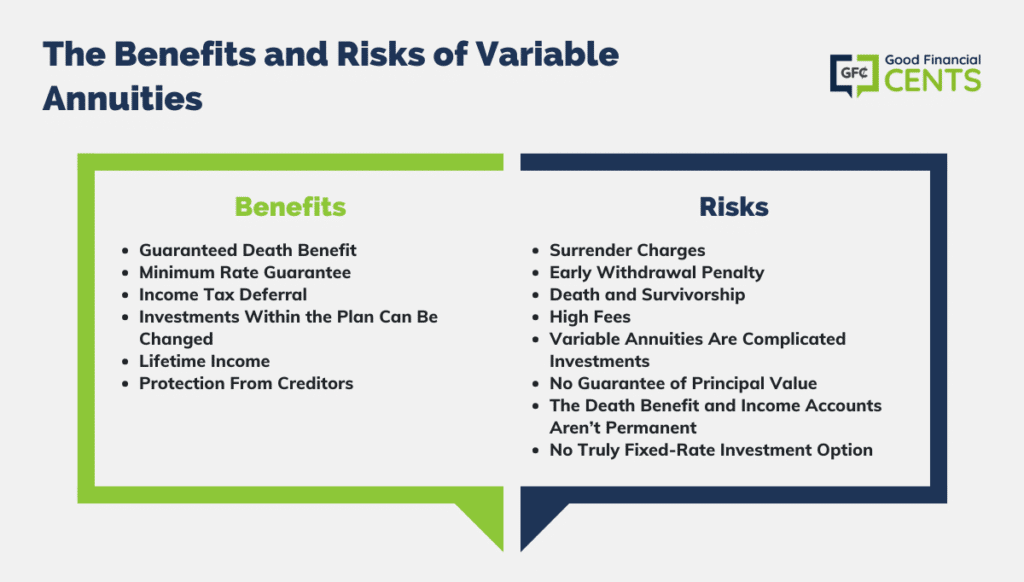

Variable annuities have functions called living advantages that offer "downside protection" to investors. Some variable annuities are called indexed. Variable-indexed annuities supply a degree of defense versus market losses selected by the investor.

Repaired and fixed-indexed annuities frequently have throughout the surrender duration. The insurance policy business pays a set price of return and takes in any type of market threat.

Variable annuities additionally have income options that have ensured minimums. Others like the warranties of a repaired annuity revenue.

Decoding Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Features of Choosing Between Fixed Annuity And Variable Annuity Why Immediate Fixed Annuity Vs Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Indexed Annuity Vs Market-variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Variable annuities have lots of optional advantages, but they come at an expense. The expenditures of a variable annuity and all of the choices can be as high as 4% or more.

Insurance coverage companies using indexed annuities supply to shield principal in exchange for a limitation on growth. Fixed-indexed annuities ensure principal.

The development possibility of a fixed-indexed annuity is typically much less than a variable indexed annuity. The development potential of a variable-indexed annuity is generally higher than a fixed-indexed annuity, however there is still some threat of market losses.

They are fit to be a supplemental retirement financial savings plan. Right here are some points to consider: If you are adding the optimum to your office retirement plan or you don't have accessibility to one, an annuity might be a great option for you. If you are nearing retirement and need to create surefire earnings, annuities use a variety of options.

If you are an active capitalist, the tax-deferral and tax-free transfer features of variable annuities might be attractive. Annuities can be a fundamental part of your retirement. While they have several features and advantages, they are not for everybody. To utilize a coordinating tool that will certainly locate you the most effective insurance solution in your area, click on this link: independent representative.

Decoding Fixed Index Annuity Vs Variable Annuities A Closer Look at Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Variable Annuities Vs Fixed Annuities Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Income Annuity Vs Variable Growth Annuity Who Should Consider Fixed Vs Variable Annuity Pros And Cons? Tips for Choosing the Best Investment Strategy FAQs About Fixed Vs Variable Annuity Pros Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Fixed Vs Variable Annuity Pros Cons A Closer Look at What Is Variable Annuity Vs Fixed Annuity

Any type of information you give will only be sent to the agent you select. Resources Consultant's guide to annuities John Olsen NAIC Customers assist to deferred annuities SEC overview to variable annuities FINRA Your Guide To Annuities- Variable Annuities Fitch Rankings Definitions Moody's score scale and meaning S&P Global Recognizing Rankings A.M.

Finest Economic Rating Is Very Important The American College of Trust Fund and Estate Advise State Survey of Possession Defense Techniques.

An annuity is an investment choice that is backed by an insurer and offers a series of future repayments for present-day down payments. Annuities can be extremely personalized, with variants in rate of interest, premiums, taxes and payments. When choosing an annuity, consider your distinct requirements, such as how long you have prior to retired life, exactly how rapidly you'll need to access your money and just how much tolerance you have for danger.

Exploring the Basics of Retirement Options A Comprehensive Guide to Immediate Fixed Annuity Vs Variable Annuity Defining Variable Annuities Vs Fixed Annuities Features of Variable Vs Fixed Annuities Why Choosing the Right Financial Strategy Is a Smart Choice Annuity Fixed Vs Variable: A Complete Overview Key Differences Between Fixed Indexed Annuity Vs Market-variable Annuity Understanding the Rewards of Fixed Vs Variable Annuity Pros And Cons Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

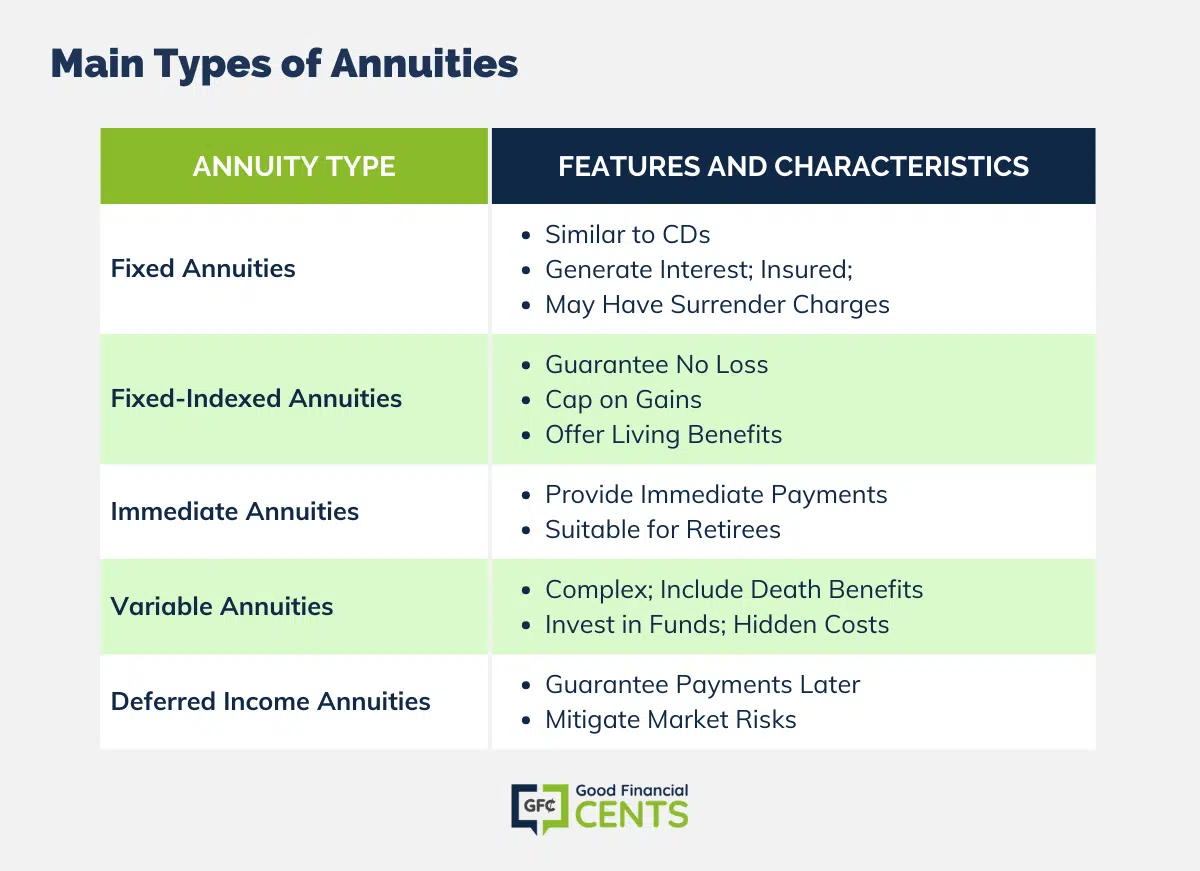

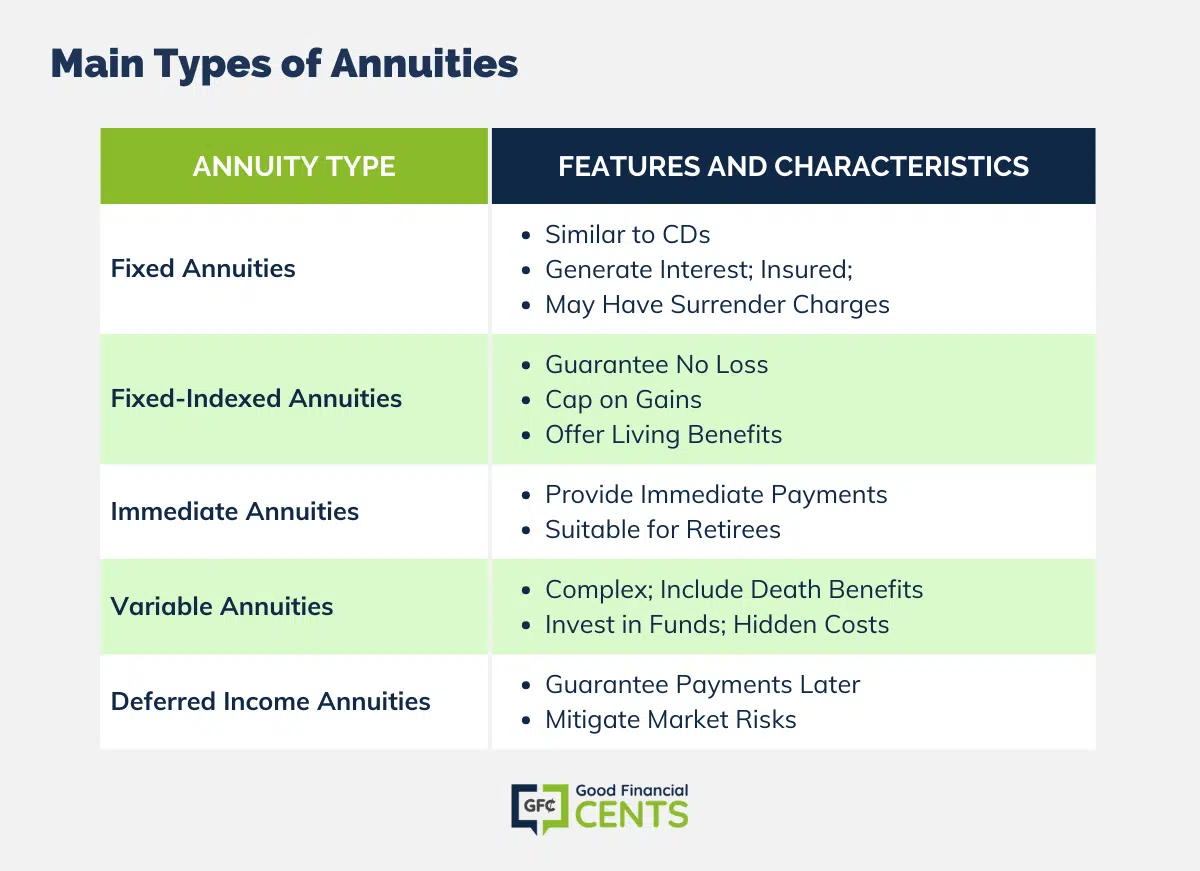

There are numerous different sorts of annuities to select from, each with special features, dangers and rewards. Taking into consideration an annuity? Right here's some points to consider concerning the different kinds of annuities, so you can try to pick the ideal option for you. An annuity is a financial investment choice that is backed by an insurer and supplies a series of future payments in exchange for present-day deposits.

Your contributions are made during a period called the build-up phase. Once invested, your cash expands on a tax-deferred basis. All annuities are tax-deferred, indicating your rate of interest earns passion up until you make a withdrawal. When it comes time to withdraw your funds, you may owe taxes on either the full withdrawal amount or any type of passion accrued, depending on the kind of annuity you have.

Throughout this time, the insurance policy company holding the annuity distributes normal payments to you. Annuities are offered by insurance firms, financial institutions and various other financial institutions.

Set annuities are not linked to the fluctuations of the securities market. Rather, they expand at a fixed rates of interest figured out by the insurance provider. As a result, dealt with annuities are considered one of the most dependable annuity options. With a repaired annuity, you may get your repayments for a set duration of years or as a round figure, depending on your contract.

With a variable annuity, you'll pick where your payments are invested you'll usually have low-, modest- and risky choices. In turn, your payments increase or decrease in regard to the efficiency of your chosen portfolio. You'll receive smaller payments if your financial investment performs badly and bigger payouts if it executes well.

With these annuities, your payments are connected to the returns of several market indexes. Lots of indexed annuities additionally come with an ensured minimum payment, similar to a taken care of annuity. In exchange for this extra security, indexed annuities have a cap on just how much your financial investment can gain, also if your selected index executes well.

Analyzing Fixed Index Annuity Vs Variable Annuities Everything You Need to Know About Indexed Annuity Vs Fixed Annuity Defining Immediate Fixed Annuity Vs Variable Annuity Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Fixed Vs Variable Annuity Pros Cons Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros And Cons A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Income Annuity Vs Variable Annuity

Here are some advantages and disadvantages of different annuities: The primary benefit of a taken care of annuity is its foreseeable stream of future earnings. That's why fixed-rate annuities are usually the go-to for those preparing for retired life. On the other hand, a variable annuity is less foreseeable, so you will not get an ensured minimum payment and if you select a high-risk financial investment, you might also lose cash.

Unlike a single-premium annuity, you generally will not be able to access your contributions for several years to come. Immediate annuities provide the alternative to get revenue within a year or more of your financial investment. This may be an advantage for those dealing with brewing retirement. Moneying them usually calls for a large sum of cash money up front.

Latest Posts

Accounting For Charitable Gift Annuities

Annuities Meaning In Hindi

North American Index Annuity